GlobalData Retail’s research shows more consumers are leaving Christmas shopping to the last minute as fewer have finished their present shopping with less than a week to go. This weekend retailers should expect a flurry of last-minute shoppers rushing to finish the last of their gift purchasing, both on the high street and online.

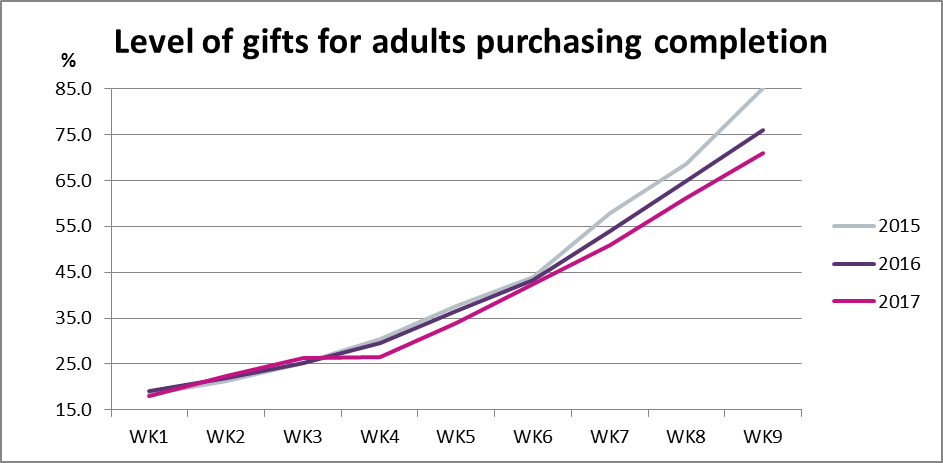

Source: GlobalData Retail’s weekly Christmas tracker, asking consumers to state what percentage of their shopping for gifts for adults has been completed. An average was then taken. Weeks correspond to the following dates: week 1 (16-22 October), week 2 (23-29 October), week 3 (30 October-5 November), week 4 (6-12 November), week 5 (13-19 November), week 6 (20-26 November), week 7 (27 November-3 December), week 8 (4-10 December), week 9 (11-17 December).

The purchase of gifts for adults has been one on the key categories impacted by this, with completion levels tracking below previous years since the week commencing 6 December. Consumers have held off spending on gifting for a number of reasons, most importantly because of retailers’ decision to heavily discount before Christmas.

More retailers than ever chose to participate in Black Friday this year, with Next announcing it would be taking part for the first time after a tough couple of months. Furthermore, Boxing Day sales have started earlier despite the fact that this discounting will further erode profit margins and may encourage shoppers to wait even longer in the coming years as they expect prices to fall further closer to Christmas Day and therefore will become reluctant to purchase gifts at full price.

In contrast, children’s gifting shopper completion levels are not lagging behind this year. Toys & games drove early purchasing as limited availability forces shoppers to buy early. This year’s latest craze, Fingerlings (small animatronic monkeys) are nearly impossible to purchase this close to Christmas. However, gifting categories for adults do not have such limited availability and consumers are less likely to shop with a specific product in mind, giving shoppers the freedom to wait until the last minute to purchase.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn the final weekend before Christmas, retailers should expect to see an influx in spend from shoppers who have held off purchasing both online and instore. Unlike in 2016, this year consumers have a full weekend before Christmas to shop, allowing those working up to the last minute to still have time to visit the shops. Furthermore, this year retailers are offering improved online delivery options. Argos boasts that shoppers can now order up until 1pm on Christmas Eve for same day evening delivery and John Lewis has extended its click & collect by an additional 24 hours, driving incremental online sales. However, with categories such as festive food and drink predominantly purchased offline, supermarkets and high streets are set to benefit the most from this delay in spending.

Related Company Profiles

Argos Ltd