UK consumer credit figures have soared, although it is likely to tighten soon with retailers bearing the brunt.

Consumer credit has recorded the highest (double-digit) growth rates since the financial crisis of 2008, amid high consumer confidence and a low-interest rate environment. This consumer credit spree has supported consumption due to stagnant wages and rising inflation. For instance, according to figures from the UK Cards Association, the weekly value of credit card transactions in April 2016 to March 2017 on clothing and footwear, household goods and other mixed business related to these products stood at £768.87m. This equals to 43.8% of the total weekly household expenditure on these products (£1.754bn) over this period, according to ONS figures. MarketLine data has shown that the UK credit cards market with a compound annual growth rate in the period 2012-16 by 4.8%. This highlights the vulnerability of UK retail as the credit spree approaches its limit.

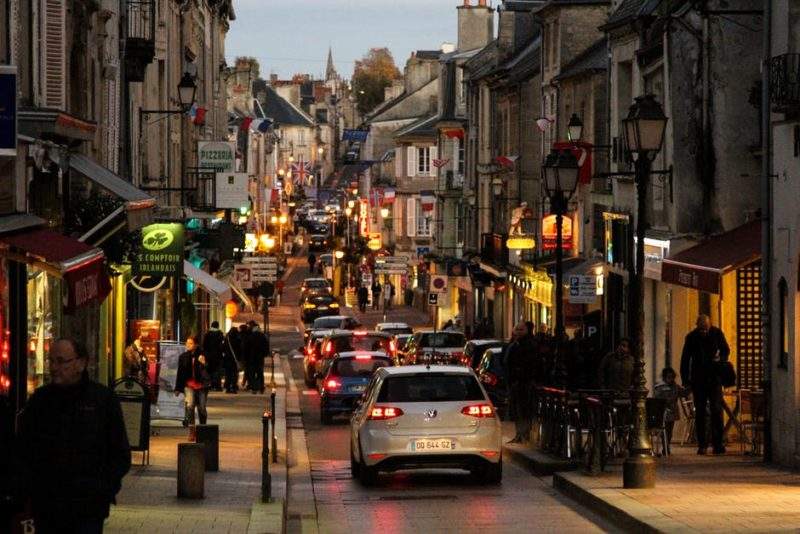

Retail sales have begun to slow – high street retailers will take the biggest hit

The effect on consumption is already showing. Since mid-2016, retail sales recorded a sharp adjustment as inflation reached record levels over a three-year period, and that diminishing trend was re-incited by the interest rate raise in November 2017.

Adversities faced by major UK high-street retailers over the last two years (House of Fraser, New Look, Debenhams) are representative of the worsening conditions in this sector. Rising business rates along with increasing competition from online retailers have impaired operating margins. The retail sales update of February 2018 that showed below expectations growth emphasizes the impact of tighter credit given high inflation and stagnant wage growth.

Credit supply will be tightened – consumption will only weaken

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAs paradoxical as it may seem, households in the UK have being increasing their consumption as much as their real income has been shrinking. Rising inflation – as the consequence of loose monetary policy and devaluation of British sterling – and suppressed nominal wage growth have reduced the real income of households. Real income has been falling since the second quarter of 2016, but unemployment had followed the same trend as well, supporting consumption over credit. However, since the unemployment rate cannot be reduced further, reaching a bottom-plateau at 4.3% since the second half of 2017, consumption cannot further increase.

Loose monetary policy is no longer effective, no longer impacting unemployment figures but also curtailing it would create a credit trap. Even if the downward trend of unemployment reverses, high household debt is unlikely to respond to further credit supply increases. Interest rates are also expected to rise in the near future, further complicating matters for the UK’s household debt.

Related Company Profiles

The UK Cards Association

Debenhams plc

House of Fraser Limited.