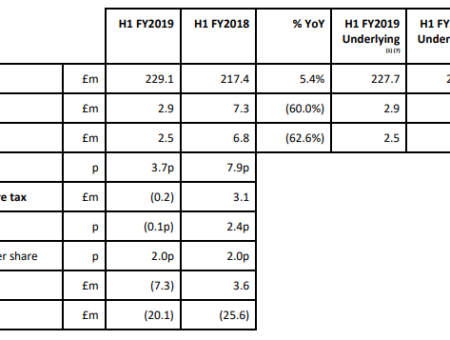

Global wine retailer Majestic Wine has dropped to a £200,000 loss in the first half of this year.

This compares to a £3.1m pre-tax profit in the same period a year ago.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Revenue for the period was up 4.8 per cent to £229.1m.

The company blamed the dip in profits on new customer investment and fixed costs.

Majestic Wine chief executive Rowan Gormley said in a statement: “We were planning for tough times and we’re investing through tough times because we know that’s the route to a more profitable future. As a result, we now have a business that is almost 45% online and over 20% international with both the option, and intention, to invest further in order to drive returns.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe Majestic Retail division contributed revenue growth of 1.9% this half year, while Naked Wines saw a revenue growth from of 14%.

The company claims its on track to meet its £500m sales target in for 2019, with the busy Christmas period still ahead.

Gormley said: “The UK retail market is tough and will continue to be a drag on performance in retail and Majestic Commercial; whereas we had previously targeted growth, we now expect FY2019 adjusted EBIT across these business units to be flat at best versus FY2018.”

Thomas Brereton, retail analyst at GlobalData, said: “Within its UK retail arm – which remains the largest contributor to group revenue, despite rapid growth in its Naked division (particularly in the US market) – the strategy to focus on existing customers is the correct one.

“Repeat customer sales retention is up 1.3ppts to 92.7%, with the nurturing of relationships between local customers and store staff responsible – one of the reasons Majestic has highlighted increasing key staff retention as a KPI.

“But at the same time, Majestic needs to make the most of seasonal periods of higher retail spend – such as Christmas – to drive brand awareness and add new customers. Its stores have not entered the ‘Christmas spirit’ as quickly as its competitors, an issue that will make it difficult given the rapidly growing wine proposition at the likes of Aldi and Lidl. Majestic should take more advantage of its specialist position within the market to generate better insights into upcoming trends – such as desire for ‘bigger is better’ bottles and the sales rise in fortified alcohols – to gain greater traction with non-connoisseurs.”

Majestic Wine has also seen key trends in its latest results including a 24% increase in the volume of rosé wine sold, a 10% increase in craft beer and still wines and a 35% growth in English sparkling wine volumes.

Read the Majestic Wine H1 2018 results statement in full.