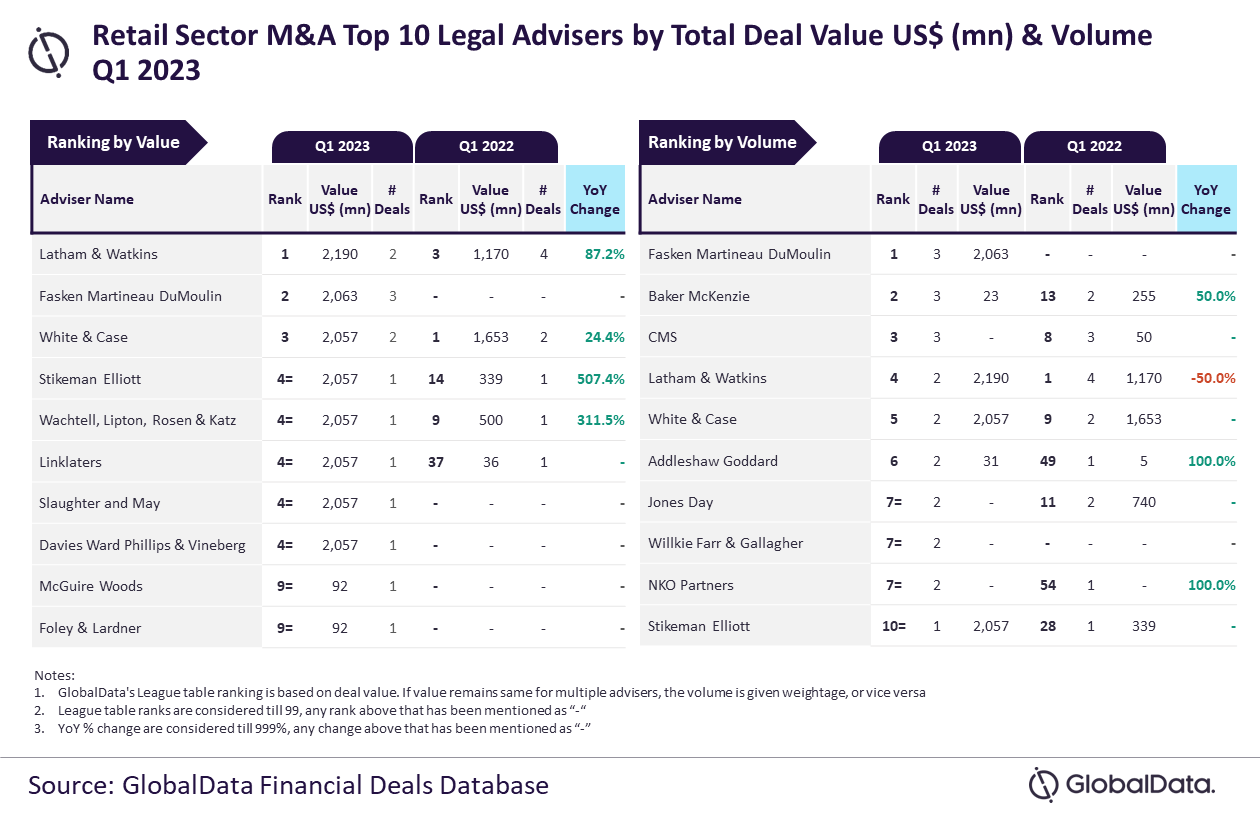

Leading data and analytics company GlobalData has published its league tables for the top ten legal advisers by value and volume in the retail sector for Q1 2023.

Latham & Watkins and Fasken Martineau DuMoulin were the sector’s top mergers and acquisitions (M&A) legal advisers by value and volume, respectively.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Latham & Watkins advised on $2.2bn worth of deals, while Fasken Martineau DuMoulin advised on three deals.

GlobalData lead analyst Aurojyoti Bose said: “The total value of deals advised by Latham & Watkins improved by 87.2% in Q1 2023 over Q1 2022. Against this backdrop, it went ahead from occupying the third position by value in Q1 2022 to top the table in Q1 2023.

“Fasken Martineau DuMoulin, i n addition to leading in deal volume, also presented a strong competition for the top spot in deal value. Ultimately, the company settled for the second position in deal value, having registered $2.1bn in Q1 2023.”

As per GlobalData’s financial deals database, White & Case took the third spot in terms of value by advising on $2.1bn worth of deals. Stikeman Elliott, Wachtell, Lipton, Rosen & Katz, Linklaters, Slaughter and May and Davies Ward Phillips & Vineberg jointly secured the fourth position, having advised on $2.1bn worth of deals each.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the volume table, Baker McKenzie secured the second place with three deals, followed by CMS with three deals, Latham & Watkins with two deals, and White & Case with two deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources in the secondary domain.

A dedicated team of analysts monitors these sources to gather in-depth details for each deal, including adviser names.

To further guarantee the reliability of the data, GlobalData also seeks submissions from leading advisers through submission forms on its website.