UK spending on Halloween is forecast to rise 3.2% in 2025 to about £537m ($716m), but weak consumer confidence and cost-conscious behaviour mean the boost will be smaller than last year’s 4.1% increase, according to a new report.

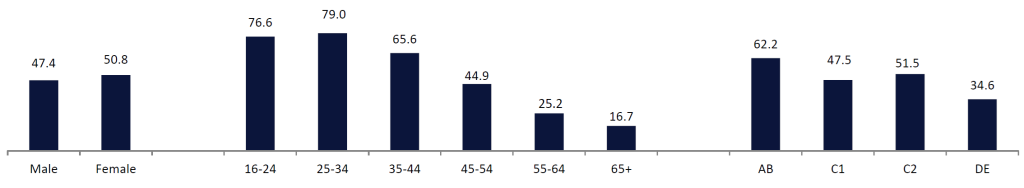

GlobalData’s Retail Occasions: Halloween Intentions 2025 report finds that, while nearly half of UK shoppers plan to take part in Halloween activities this year, 60% of those intending to shop for the occasion expect to cut back because of financial pressures. The most pronounced retrenchment is among 25 to 34-year-olds – a key demographic for seasonal impulse purchases.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

GlobalData notes that much of the headline growth reflects price rises – particularly in food & drink – rather than a meaningful increase in consumer demand. That means retailers face a tougher sell for discretionary categories such as decorations and costumes, where shoppers are more likely to trade down or skip purchases entirely.

“Retailers should promote low-cost Halloween items such as themed candles, drinks and snacks to encourage small impulse purchases and boost volumes,” said Eleanor Simpson-Gould, senior retail analyst at GlobalData. The company recommends ranges designed to trigger affordable indulgence and curiosity rather than high-ticket buys.

The report signals clear opportunities for grocers and non-food retailers prepared to adapt assortments:

- Food & drink: Demand will centre on traditional items – pumpkins, trick-or-treat multipacks and seasonal drinks. Retailers can extract margin and interest by launching limited-edition or mystery-flavour SKUs in premium own-brand ranges, echoing moves from specialist retailers. GlobalData highlights Fortnum & Mason’s limited-edition Halloween hamper as an example of how luxury, curiosity-driven ‘productisation’ can elevate the occasion.

- Decorations and non-food: To extend relevance beyond 31 October, ranges should blend Halloween iconography with broader autumnal motifs. Lower risk, multipurpose homewares (pumpkin-inspired ceramics, table linens, candle holders) and seasonal loungewear or pyjamas create a longer selling window and higher perceived value, the report says – citing Flying Tiger’s pumpkin-themed range as a model.

- Price-focused merchandising: Emphasise low-cost addons and impulse buys to capture cautious shoppers, particularly younger adults who remain the most budget sensitive.

A deeper challenge identified by GlobalData is that a significant share of consumers view Halloween as an unnecessary expense, lacking the family-wide appeal of occasions like Mother’s Day and Christmas. Shifting that perception, the company contends, requires innovation and products that feel enduring or collectible rather than purely disposable.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor retail executives, the implications are clear: drive footfall and basket value via affordable, curiosity-led product launches and limited editions; use premium own-brand credentials to create differentiated seasonal offers; and design non-food ranges that deliver utility through the autumn period rather than a one-day spend spike.