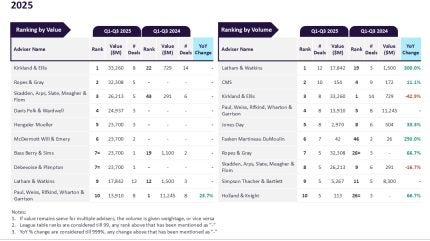

Kirkland & Ellis and Latham & Watkins were the leading legal advisers on retail sector mergers and acquisitions (M&A) in the first three quarters of 2025, according to GlobalData, a data and analytics company.

GlobalData’s financial deals database showed Kirkland & Ellis leading by value, with advisory on deals totalling $33.3bn during the period.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Latham & Watkins topped the rankings by volume, with 12 deals over the same period.

Ropes & Gray was second by deal value, with $32.3bn of advised transactions.

It was followed in the value rankings by Skadden, Arps, Slate, Meagher & Flom ($26.2bn), Davis Polk & Wardwell ($24.9bn) and Hengeler Mueller ($23.7bn).

In the volume rankings, CMS took the second spot with ten deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataKirkland & Ellis, Paul, Weiss, Rifkind, Wharton & Garrison and Jones Day each advised on eight retail M&A transactions.

GlobalData lead analyst Aurojyoti Bose stated: “There was an improvement in the total volume of deals advised by Latham & Watkins during Q1 to Q3 2025 compared to Q1 to Q3 2024. Its ranking by volume also improved from the 19th position to the top position. Latham & Watkins also held the ninth position by value during Q1-Q3 2025.

“Meanwhile, Kirkland & Ellis registered a massive jump in the total value of deals advised by it during Q1 to Q3 2025 compared to Q1 to Q3 2024, driven primarily by its involvement in $23.7 billion deal for the acquisition of Walgreens Boots Alliance by Sycamore Partners. [As a result], t went ahead from occupying the 22nd position by value during Q1-Q3 2024 to top the chart by this metric during Q1-Q3 2025.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.