UK-based luxury watch manufacturer Bremont has sold a substantial minority interest in its business to billionaire hedge fund manager Bill Ackman and his affiliate.

The Financial Times reported that Ackman and existing investor Hellcat invested £48.4m ($59m) in Bremont, taking the company’s valuation to more than £100m ($123m).

Ackman said: “I have long admired Bremont’s handsomely designed, technologically sophisticated and rugged watches, and the brand’s storied aviation and military history.

“I am thrilled to have the opportunity to become a shareholder of Bremont at a fulcrum point in the company’s evolution, and to see it take its rightful position as a global leader in watchmaking.”

Bremont will use the proceeds from the investment to fund its multi-channel, multi-market expansion worldwide, including opening boutiques in the US and other markets.

The company will also aim to expand its wholesale business, increase its joint venture partnerships and improve its brand visibility.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBremont co-founder Giles English said: “Nick (English, co-founder) and I are thrilled that Bill has moved from collector to investor, joining our long-standing shareholder, Hellcat, as partners in Bremont.

“This new capital will enable us to invest in marketing, distribution and talent. This is not just a boost for Bremont, but also for Britain.

“The British watch industry is the birthplace of some of the most important timekeeping innovations, including the perpetual calendar, and we are delighted to continue our country’s history of manufacturing and innovation through the global growth of Bremont.”

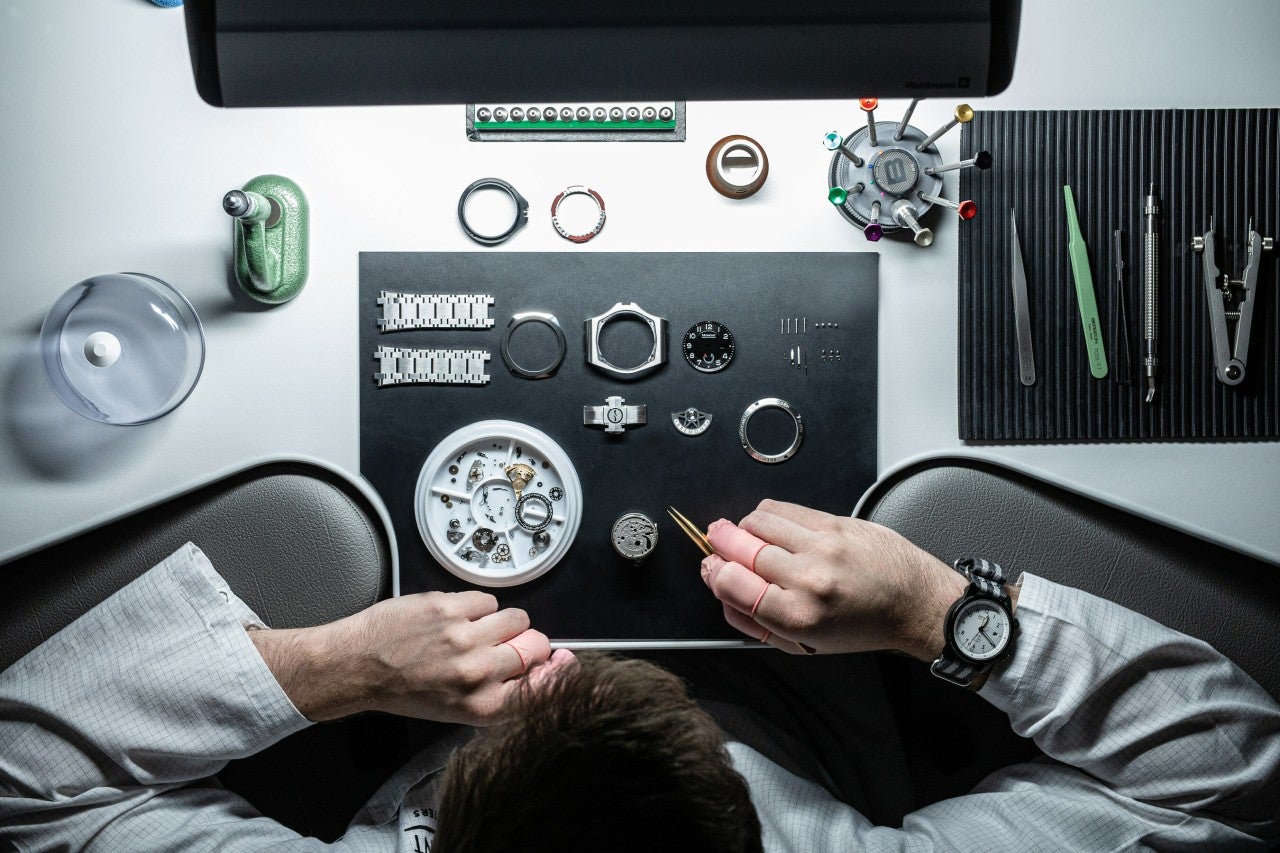

Bremont recently opened an advanced manufacturing and technology centre in Henley, UK.

Called The Wing, the 35,000ft² facility has made Bremont the first business to manufacture mechanical movements at scale in the UK in more than 50 years.

The company registered an annual revenue growth of 28% in the most recent financial year.