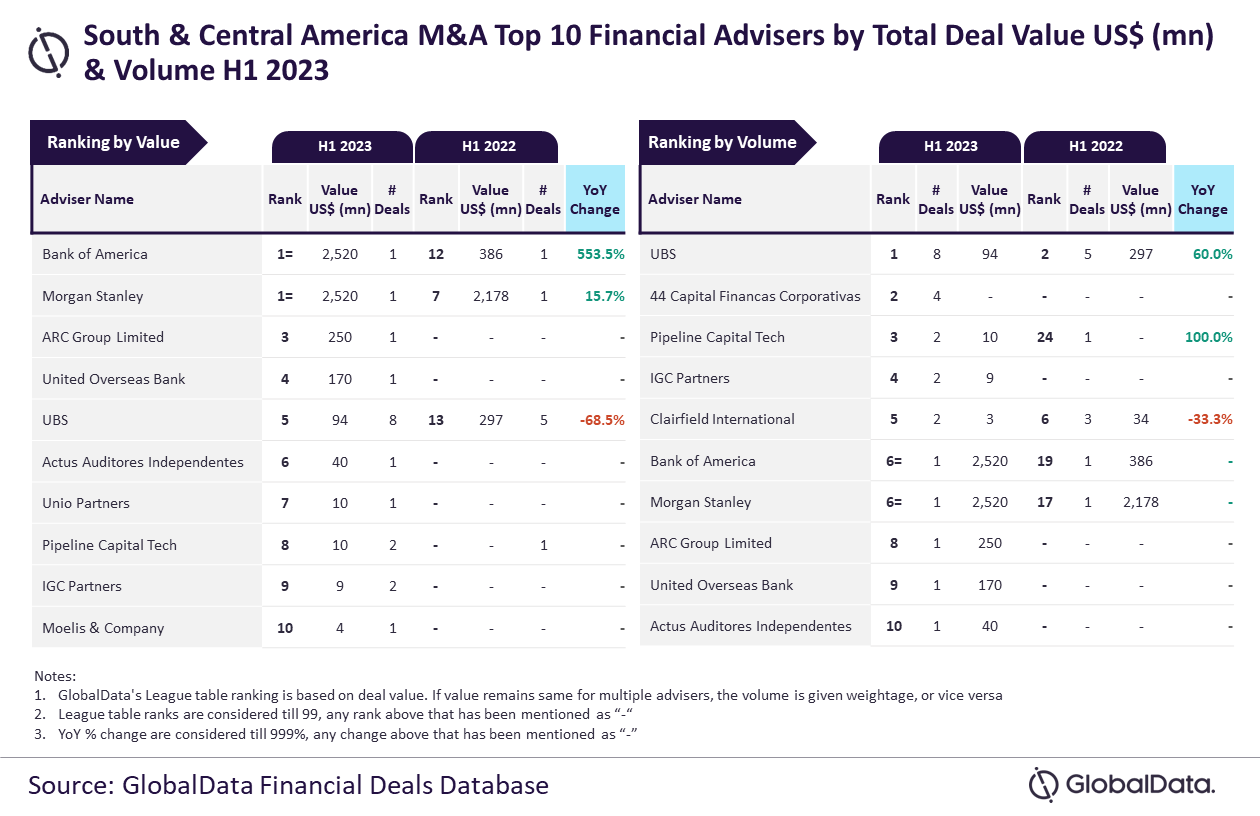

UBS was the top mergers and acquisitions (M&A) financial adviser in South & Central America region in H1 2023 by volume, while Bank of America and Morgan Stanley jointly held the top position by value, according to GlobalData’s latest league table.

The leading data and analytics company ranks advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, UBS led in terms of volume by advising on a total of eight deals. Bank of America and Morgan Stanley achieved the leading position in terms of value by advising on $2.5bn worth of deals each.

“Both Bank of America and Morgan Stanley registered growth in deal value that helped them improve their rankings by value in H1 2023 over H1 2022,” said GlobalData lead analyst Aurojyoti Bose. “Bank of America witnessed 553.5% growth in total deal value and went ahead from occupying the 12th position by value in H1 2022 to top the chart by this metric in H1 2023.

“Similarly, Morgan Stanley registered 15.7% growth in total deal value and went ahead from occupying the seventh position by value in H1 2022 to top the chart by this metric in H1 2023. Meanwhile, UBS, which lead by volume, fell short of only two deals from touching double-digit deals volume.”

ARC Group Limited came third in terms of value, by advising on $250m worth of deals, followed by United Overseas Bank with $170m and UBS with $94m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRunners-up in terms of volume were 44 Capital Financas Corporativas with four deals Pipeline Capital Tech with two deals, IGC Partners with two deals and Clairfield International with two deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.