The price of infant formula in the UK has been steadily moving upwards in recent quarters, with some products hitting as much as £18 ($23).

The trend has prompted the UK’s Competition and Markets Authority (CMA) regulator to launch a market study into the sector.

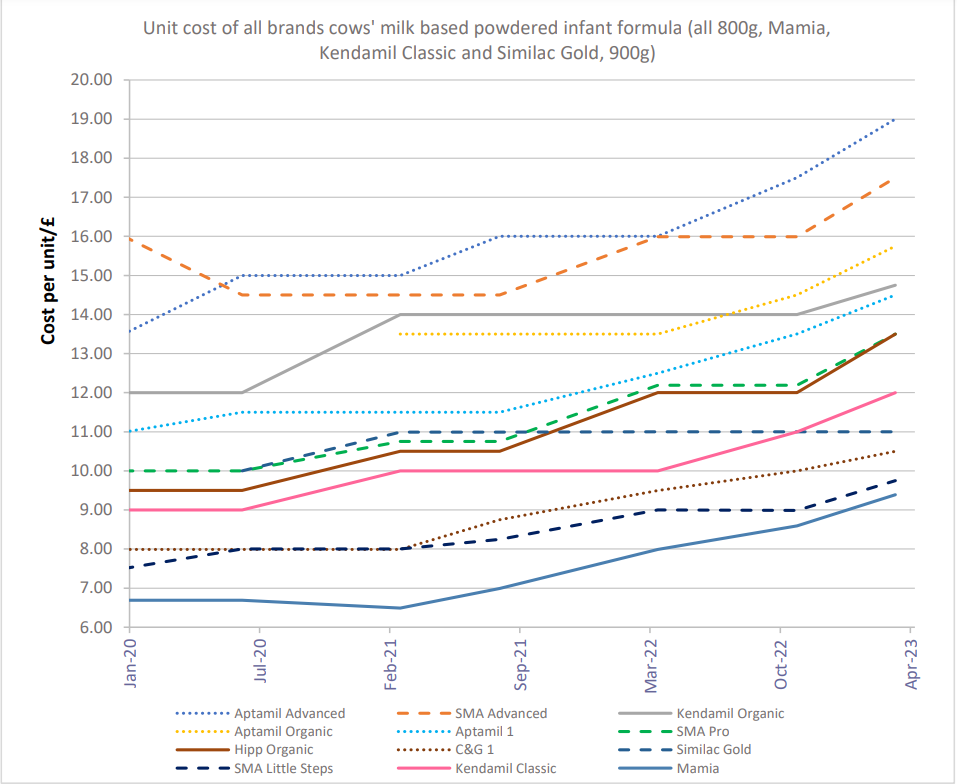

The announcement follows the publication of a report by the CMA in November, which found infant formula prices in the UK had increased by 25% between March 2021 and April 2023. It noted “manufacturers have increased their unit prices for infant formula by a higher amount than their costs have increased, leading to increasing unit profitability (in £ per kg).”

For low-income families struggling with pressures on household bills, the rising cost of formula has put some products out of reach. Until Aldi reduced the price of its own-brand Mamia this week, the cheapest product on the market was £9.39 – more than the weekly £8.50 provided by the Healthy Start scheme, which gives UK benefits claimants financial assistance to buy food and milk for young children.

The rising price of infant formula

Danone (which owns the Aptamil and Cow & Gate brands) and Nestlé (owner of SMA) dominate the UK’s infant formula market, comprising 85% of sales. They are followed by Kendamil, which accounts for 9% of the market sales.

All the major brands have increased their prices over recent years, according to First Steps Nutrition Trust, which tracked the unit costs of various infant formula brands since January 2020. It found the most widely available and purchased infant formulas increased in price by between 17% (Aptamil Organic) and 31% (Cow & Gate), with the cheapest option (Aldi’s own-brand Mamia) seeing an increase of 45%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSince the publication of the CMA report, Danone has announced it will cut the wholesale price of its Aptamil infant formula by 7%, while Aldi has this week reduced the price of its Mamia to £8.49 for 900g, which it says is the lowest available.

Of the rising prices, Danone, which controls 71% of the market, tells Retail Insight Network: “We recognise the challenges faced by parents due to inflation. During this difficult period, we have worked very hard to absorb the significant cost increases we have faced, make savings, and minimise any price increases. In order to offer parents the best value, and to ensure we are as competitive in the market as possible, we have also launched new larger, better value formats.”

Nestlé, with 14% of the market, adds: “We have been seizing all possibilities to create operational efficiencies and absorbed increasing costs before considering responsible price increases. Through these measures, we have kept products affordable and accessible to consumers while ensuring fair prices for our suppliers and farmers.”

The reasons behind the higher prices

While brands have pointed to inflation as the reason for price increases, GlobalData analyst Hannah Cleland believes there has been an element of ‘greedflation’ at play – the raising of prices veiled by inflation but at higher rates than inflation to increase profitability.

“In general, grocery price hikes since the start of recent hyperinflation have increasingly caused consumers to become sceptical of whether prices are a true reflection of macro pressures or an excuse for brands to increase profit margins,” she says.

Greedflation in the food industry – myth or mystery?The CMA has raised concerns over the availability of information to parents making decisions about infant formula milk. All formulas are nutritionally equivalent but confusing marketing can persuade parents to spend more than necessary. A consumer survey carried out in the third quarter of last year by GlobalData, Just Food’s parent, found UK consumers preferred to pay more for baby and childcare products to ensure that quality is uncompromised.

Vicky Sibson, director at the First Steps Nutrition Trust charity, calls these brand strategies “inappropriate”, telling Just Food she hopes the CMA study will “expose the abusive marketing and pricing strategies of the big formula milk brands, and make strong recommendations to address these”.

Her concern around approaches to pricing is echoed by Will McMahon, co-founder at Kendamil.

“UK families are struggling to feed their children in today’s cost-of-living crisis, exacerbated by a situation in which 85% of all formula sales are controlled by two multinational conglomerates (with over £15bn in annual profits),” says McMahon. “This extreme supply concentration in turn promotes monopolistic behaviour, a concerning lack of supply diversification and in our view, unjustifiable pricing strategies.”

Formula production costs are rising

Despite these concerns, Rima Mittra, principal consultant and in-house microbiologist at Netherlands-based FutureBridge, says some price rises can be at least partially attributed to increasing input costs – and partly from R&D. Mittra explains the lack of competition in the market has created a space of expensive innovation.

“One of the major things that we are seeing in infant formula is that there are a lot of new solutions coming with blends,” she says. “A lot of the key players in the market are trying to make the formulas as close as possible to the breast milk. It takes a lot of ongoing research and a lot of time for them to introduce it into the market, and the production costs are going to be high.”

Limited suppliers of the ingredients needed for new blends can also drive up prices. Mittra offers the example of lutein, a carotenoid currently only added to Abbott’s Similac formula, which also 20 human milk oligosaccharides.

“Because there are fewer suppliers for the new ingredients being researched and introduced into the baby milk formula, the price is increasing, but this could change when production is scaled up,” she says.

However, Sibson argues that this ingredient innovation is unnecessary, as “all infant formulas are nutritionally equivalent as they must adhere to UK law which sets out the composition.”

Costs associated with the research and development of new ingredients for formula blends are therefore the choice of the brands, rather than a nutritional necessity, some would argue.

The CMA investigation

The CMA will look to publish its final report on its investigation into infant formula prices in September and will consider the driving choices of consumer behaviour, the role of the regulatory framework in influencing the market, and potential barriers to entry and expansion.

Sarah Cardell, CEO of the CMA, has said of the study: “We are determined to ensure this market is working well for the many new parents who depend on infant formula and it’s essential that any changes we propose are based on evidence and a strong understanding of the market. That’s why we’ve now decided to take forward our work on infant formula as a market study, using our formal legal powers.”

The study will enable the CMA to use its compulsory information-gathering powers, instead of relying on the voluntary provision of information by brands, and its recommendations to the government will have a formal status.

Of its hopes for the CMA study, Danone tells Just Food: “In Danone’s experience the formula milks market is competitive. We are committed to best practices to maintain this and will continue to work constructively on ways we can continue to deliver value and innovation to parents. We look forward to continuing our cooperation with the CMA regarding its review of the market and ensure parents are supported as much as possible.”

Its closest competitor in the market, Nestlé, adds: “We believe that it’s important to make sure that parents who decide to formula-feed their babies have reliable and safe access to formula, and choices in the formula that they give their baby. We welcome the review of the industry by the CMA, this is a complex and serious issue and we are open to all constructive dialogue to help parents in the most effective way possible.”