Card Factory has a clear opportunity to bolster its weaker online proposition with its acquisition of Funkypigeon, but must fix issues with fulfilment and product innovation that are currently limiting Funkypigeon’s performance. Unlike Card Factory’s failed Getting Personal venture, Funkypigeon comes with strong brand recognition, a large customer base and a loyalty scheme, providing a strong starting point from which to boost Card Factory’s underperforming online channel. Given that the online stationary and cards market is also expected to continue performing well over the next five years, there is an opportunity for Funkypigeon and Card Factory to capture a larger market share if these issues are addressed.

Funkypigeon grew a sluggish 1.5% compound annual growth rate (CAGR) between 2019 and 2024, significantly lower than the stationery and greeting cards online market CAGR of 6.3% and the impressive 17% CAGR of its primary competitor, Moonpig. Card Factory will need to address Funkypigeon’s delivery proposition to enhance its revenue results. Consumer reviews frequently highlight issues with their orders arriving significantly later than the expected delivery time. In a sector where products are often needed urgently for occasions such as birthdays and anniversaries, late arrivals harm brand trust and risk further erosion of market share.

Fortunately, Card Factory’s operational strengths, such as its manufacturing and distribution infrastructure, offer a pathway to improvement. As the leading greetings card retailer in the UK, Card Factory possesses significant advantages that it can leverage to support Funkypigeon’s development. The retailer already has an impressive market share and the scale to bring efficiencies, and can utilise operational synergies between Funkypigeon’s printing and Card Factory’s manufacturing to lower costs and improve speed. If Card Factory can effectively integrate Funkypigeon’s digital platform with its current omnichannel capabilities to optimise fulfilment, the acquisition will significantly enhance both brands’ online positioning.

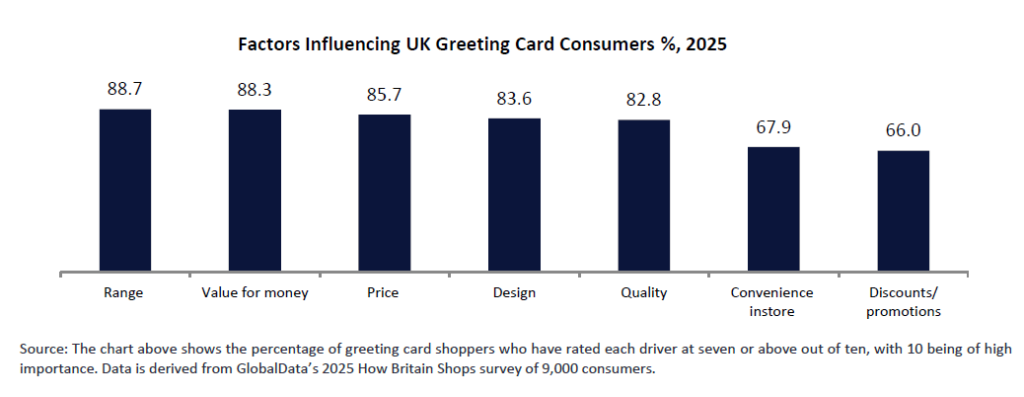

Card Factory must also prioritise innovation in Funkypigeon’s product offer to gain market share. Competitor Moonpig attributed its 10% revenue growth for the six months ending 31 October 2024 to investment in personalisation technology, which included features such as audio and video messages, AI-generated text suggestions, digital gifting solutions and an AI-powered handwriting tool. Product range was the most integral driver for greeting card shoppers in the UK in 2025, with 88.7% of consumers rating it at seven or more in terms of importance. By adopting similar innovative strategies and maintaining a focus on the key drivers for greeting card shoppers in the UK, Card Factory can enhance Funkypigeon’s proposition and create a more engaging customer experience.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData