With the bottom three-fifths of UK consumers seeing no growth or even a decline in their real discretionary incomes since 2019, according to GlobalData’s analysis of ASDA’s income tracker, the appeal of low-cost secondhand furniture has significantly boosted the popularity of resale over traditional retail purchases.

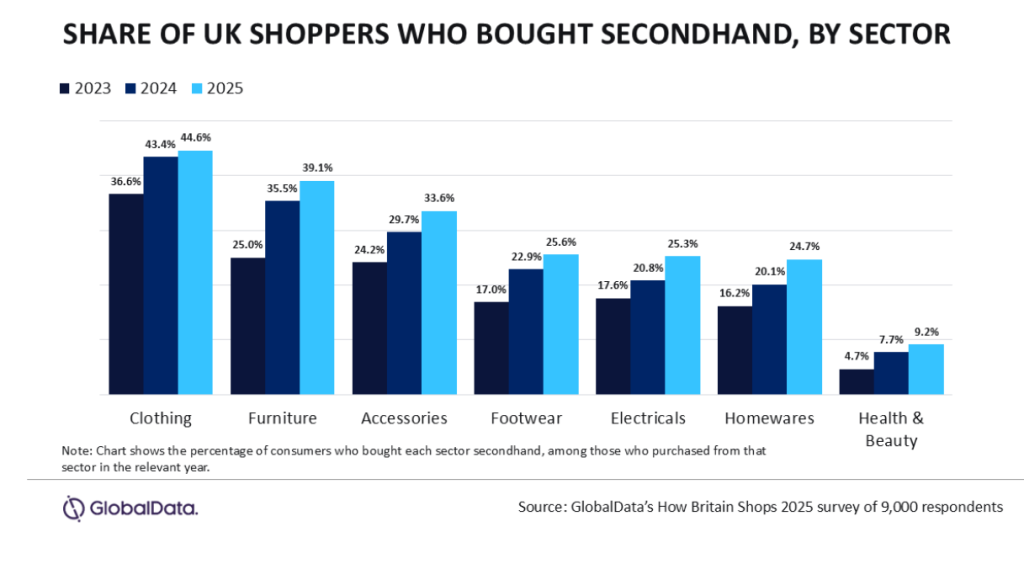

The share of UK furniture shoppers who report having bought secondhand furniture has increased more than for any other major retail sector, rising 14.1ppts between 2023 and 2025 to 39.1%. The draw of secondhand is clear – financially-pressed consumers can purchase higher quality furniture for a lower price than they would have been able to purchase from a retailer. Indeed, consumers consistently cited the desire to save money or find a bargain as by far and away the most significant driver for shopping secondhand across all sectors. Since competing with secondhand on price is not a realistic option, furniture retailers must emphasise different USPs to justify their higher price points.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

IKEA and Argos have been particular victims of furniture shoppers opting for secondhand alternatives, with their financially pressed lower-income customer bases more likely to do so, or to put off spending altogether. Meanwhile, better-off consumers have begun trading up to the likes of The Cotswold Company, which saw a 30% increase in its first half sales to August 2025.

To win back consumers who have switched to secondhand in the short term, IKEA and Argos must make better use of their existing infrastructure. IKEA has attempted to internalise the resale market with its buyback programme, but these items are often difficult to find in its already hard-to-get-to stores. The company has experimented with more prominent placement of its resale proposition in its Oxford Street store, but there is scope to apply similar thinking to its other newer small-format and city centre stores, such as those in in Brighton and Harlow, which would help to create a more viable alternative to the likes of Facebook Marketplace.

Argos could enhance its marketplace-style “stockless ranges” by ensuring the fastest and most convenient delivery options are available for third-party sales, and roll out a more comprehensive interest-free credit offering to ladder-up lower-end consumers.

Other retail sectors are also experiencing a rising share of secondhand, with retailers adapting to the changes according to sector’s characteristics. For electricals, where the online market is more mature and retailers often sell the same items, convenience and quality are not effective differentiators. Retailers are seeking to offer a wider range through third-party suppliers (either in the form of marketplaces or supplier direct fulfilment models) as well as supplementing their retail revenues with subscription-based supplemental services such as Currys’ iD Mobile or Apple One.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, the apparel sector faces disruption from not just the likes of Vinted, but also ultra-low cost player Shein. Next and M&S are both expanding their brand portfolios to compete on range, while Primark has introduced Click & Collect to compete on convenience. Moving forward, players will increasingly have to compete on the basis of quality – the low-cost, low-quality aspect of the market is comfortably covered by Shein, and Next has already noted its shoppers opting to buy fewer, higher quality items.

While resale is a key threat to both Argos and IKEA in furniture, they also need to be cognisant of consumers trading up. The retailers should take inspiration from Dunelm, M&S and Next’s broad price architectures, which allow them to retain customers seeking to trade up. While neither Argos nor IKEA is limited on range breadth, this suggests that both would benefit from better curating their ranges. Argos’ existing online-first, range and convenience-driven model is currently risking direct competition with Amazon (a battle it will surely lose), while IKEA’s price architecture is poorly communicated, and its more premium Stockholm line still struggles to compete on quality with more upmarket players.