British retail sales experienced a significant rebound in April, surpassing economists’ expectations, as the impact of bad weather on spending in March began to fade and government benefits increased.

According to data released by the Office for National Statistics (ONS), the quantity of goods purchased in Britain rose by 0.5 percent between March and April, partially reversing the sharp decline from the previous month.

This growth exceeded the forecasted 0.3 percent expansion predicted by economists polled by Reuters. However, the initial estimate of March’s contraction was revised from 0.9 percent to a steeper decline of 1.2 percent.

In an email to Retail Insight Network, Silvia Rindone, EY UK&I Retail Lead wrote: “The Easter bank holiday weekend positively impacted both food and non-food sales, which rose by 0.7% and 1%, following a fall the previous month. While a marginal uplift, this is the first-time seeing growth in food sales since August 2022.”

Retail sales show promising 3-month growth rate

Over the three-month period leading up to April, sales volumes in the retail sector increased by 0.8 percent compared to the previous three months, marking the highest growth rate since August 2021.

Grant Fitzner, the chief economist at the ONS, noted that various sectors experienced positive performance, with jewellers, sports retailers, and department stores all reporting a successful month.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDepartment stores, in particular, saw their sales volumes rise by 1.7 percent in April, recovering from a 3 percent decline in the prior month.

Food stores also displayed improvement, with sales volumes edging up by 0.7 percent after a decrease in March, although they remained 2.7 percent below the levels recorded in February 2020, prior to the onset of the coronavirus pandemic.

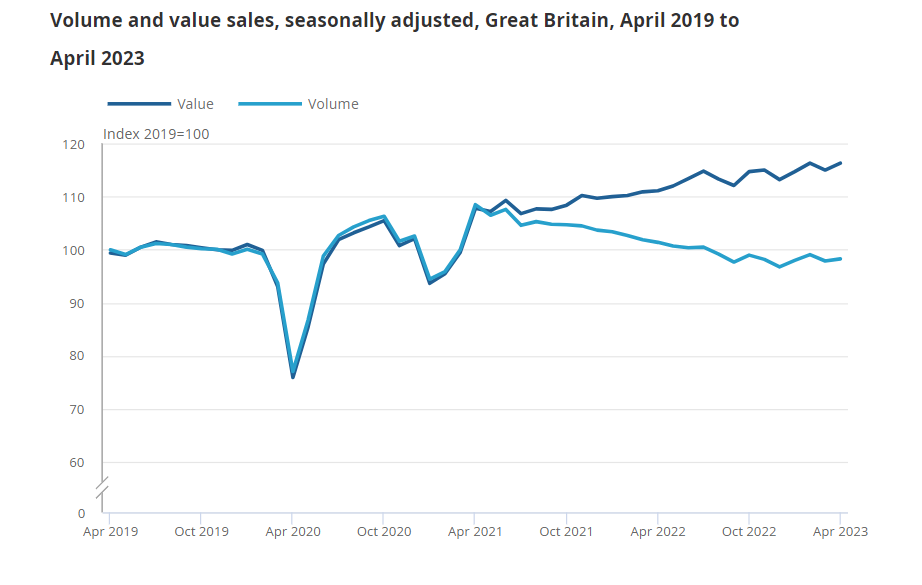

Divergence between retail sales volumes and values

Source: The Office of National Statistics (ONS)

Sales increase due to improved weather conditions

Ashley Webb, a UK economist at Capital Economics, suggested that the increase in sales might be attributed not only to the return of more seasonable weather in April but also to the boost in household incomes resulting from larger-than-usual rises in state pensions, welfare payments, and the minimum wage in early April.

Inflation-adjusted government benefits payments rose by 10.1 percent in line with the September 2022 inflation rate, providing support to household finances.

While retail sales volumes in April were down by 3 percent compared to the same period last year, indicating the impact of high inflation on households’ finances, consumer spending outlook is showing signs of improvement.

Martin Beck, chief economic adviser to the EY Item Club, pointed out that the jobs market has proven resilient and consumer sentiment is beginning to recover.

However, UK inflation remained high, falling slightly less than expected to 8.7 percent in April, with food inflation hovering near its 45-year peak at 19.1 percent.

This has heightened market expectations for further interest rate hikes, which could result in higher mortgage payments for millions of households.

Looking ahead, retailers are optimistic about the future. Aled Patchett, head of retail and consumer goods at Lloyds Bank, expressed hope that three bank holidays, warmer weather, and recovering confidence would provide a much-needed boost to sales in May.

Gabriella Dickens, economist at Pantheon Macroeconomics, predicts that the recovery will continue throughout the quarter, as falling energy costs and easing inflation contribute to the restoration of real disposable incomes.

As a result, retail sales are expected to continue picking up in the third quarter of the year.