In an evolving UK health and beauty market in which consumers’ preferences constantly shift, retailers must increase their partnerships with emerging brands to capture the attention of discerning younger generations. Social media platforms such as TikTok have accelerated shoppers’ exposure to emerging beauty trends, and 41% of UK consumers stated they would try a trending beauty technique out of curiosity, up 6 percentage points (ppts) from 2024. Given the growing influence of social media, especially among young consumers, retailers must swiftly incorporate new brands into their offers and seek exclusive partnerships to capitalise on the latest social media trends.

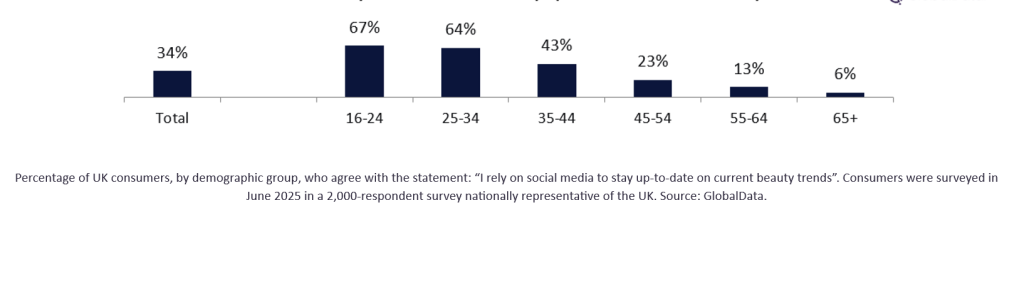

UK consumers who rely on social media to stay up-to-date on current beauty trends

GlobalData’s June 2025 monthly survey of 2,000 UK respondents reveals that 34% of consumers rely on social media to stay up-to-date on current beauty trends, a 6 ppt increase on 2024. Younger consumers are driving this sentiment, with 67% of 16-to-24-year-olds relying on social media, indicating this is a primary source of inspiration for the demographic. However, the fleeting nature of trends on social media presents a challenge for retailers, as what was popular a few months ago may no longer hold the same relevance.

Retailers should partner with trending brands, ensuring they improve their perception among this younger age group. For example, awareness of trends such as slugging (the practice of applying a thick, occlusive ointment such as Vaseline as the final step in a nighttime skincare routine) and at-home teeth whitening has declined in 2025 compared to the previous year, while awareness of skin flooding (a skincare technique that involves layering multiple hydrating products on damp skin to maximise moisture absorption and retention) and light therapy has risen.

Working closely with third-party brands specialising in these trends to secure small-batch or limited-edition runs of trending products will enable retailers to keep up with rapidly changing trends without the risk and cost of developing and launching their own-brand alternatives. Given the pace at which new health and beauty trends emerge through social media, retailers must ramp up investment in category analysis capabilities. This development must involve prioritising trending brands within social media marketing and allocating high-visibility shelf space in stores to these items. Market leader Boots has recognised this shift in consumer preferences and has been actively refreshing its brand selection to reflect this. The retailer has introduced popular K-beauty brands such as Laneige and Beauty of Joseon, along with new brands such as Humantra, in June 2025. Boots’ strategy for expanding its market reach has been effective; it is attracting younger consumers while still appealing to its existing diverse customer base.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData