The UK government’s battle against inflation has given rise to a bafflingly, unworkable and inequitable proposal to get supermarkets to ‘voluntarily’ cap certain food prices. The underlying assumption is that supermarkets are not doing all they can on the prices of essential foods and are profiteering by using inflation as an excuse to increase prices faster than they need to.

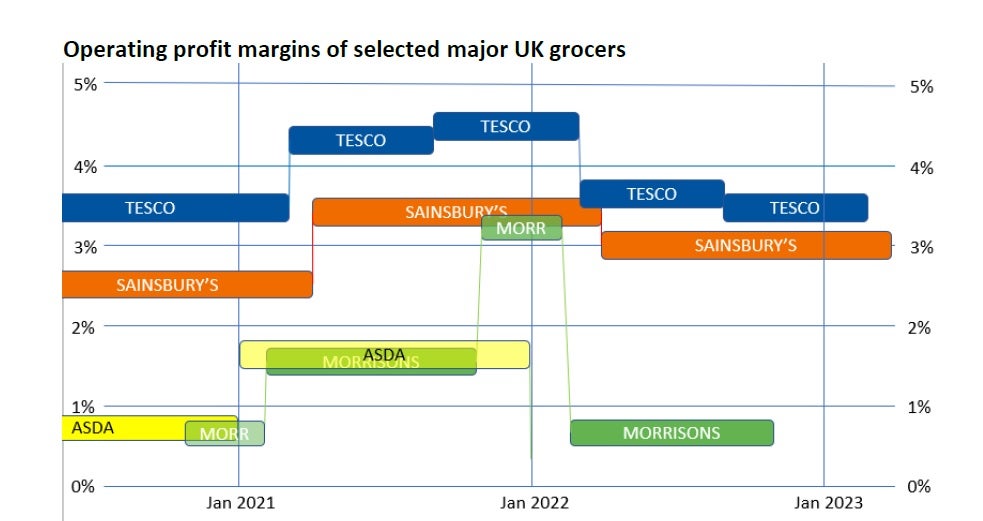

For accusations of ‘greedflation’ to be true, we would have seen a sharp uptick in supermarket profits by now, but looking at the results of those supermarkets that have released profit figures for 2022, we can see that profit margins are, in fact, falling. Margins are currently sub 4% giving little room for further price cuts unless costs, such as what they pay staff, farmers and manufacturers, are also reduced.

Source: Company press releases. Note: Profit metrics differ between retailers and are not all directly comparable. Morrisons = operating profit margin before exceptionals, Tesco = UK & ROI retail incl fuel adjusted operating profit margin, Sainsbury’s = adjusted operating profit margin, Asda = operating profit margin. For 2022 Asda has only reported an adjusted EBITDA excl fuel (5.7% vs.4.3% in 2021).

The UK grocery market works well – in that, it’s very competitive on price. While Tesco is the largest player by far, it, along with the other members of the group formerly known as the Big 4, has had to be ruthless on prices and costs to be able to compete with Aldi and Lidl, who have been expanding rapidly. A major supermarket is more likely now than ever to have a rival in proximity. So it cannot rely on customer inertia, and the rise of online grocery means that it cannot afford to be out of line with any of its competitors.

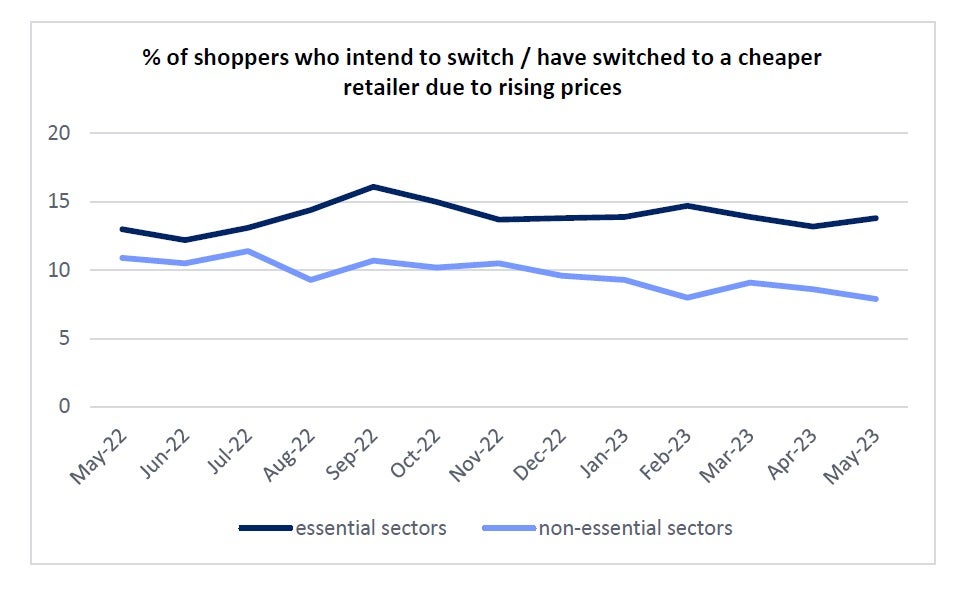

Shopper loyalty is harder to maintain than ever and supermarkets’ fear of customers switching is high. According to our survey data, shoppers have increased their propensity to switch retailers in essential sectors (food & groceries and toiletries) over the last year in order to counteract inflationary prices. However, it is in the non-essential sectors that the propensity to switch has always been lower and has decreased over the last 12 months, as some choose to cut back altogether rather than switch.

Consumers are driving retailers, supermarkets in particular, to be more competitive and government intervention would be more efficiently focussed on direct financial help for those most in need.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

The nature of a voluntary cap seems unworkable. The suspicions are that this is political grandstanding rather than a genuine attempt to help those more impacted by rising prices. While many have made the case that it is the lower value

ranges that have suffered the highest percentage price increases, this is because the commodities that have increased so rapidly make up a larger proportion of their shelf prices.

These are still extremely low-margin items, as this is the area where the price battles between the supermarkets take place and the major players have strengthened their value ranges and extended their distribution. It is in other ranges, with less frequently bought products, where supermarkets see opportunities for more beneficial margins.