Amazon has announced the launch of its two-day Prime event set to take place in the UK on 11- 12 July.

However, leading data and analytics company GlobalData says that the pureplay giant will need to provide a compelling promotional event to entice spending and halt the decline in Prime Day participation.

GlobalData senior retail analyst at Eleanor Simpson-Gould comments: “To boost Prime Day participation, Amazon must offer unmissable deals on top brands to stand out among the many retailers already advertising a plethora of discounts.”

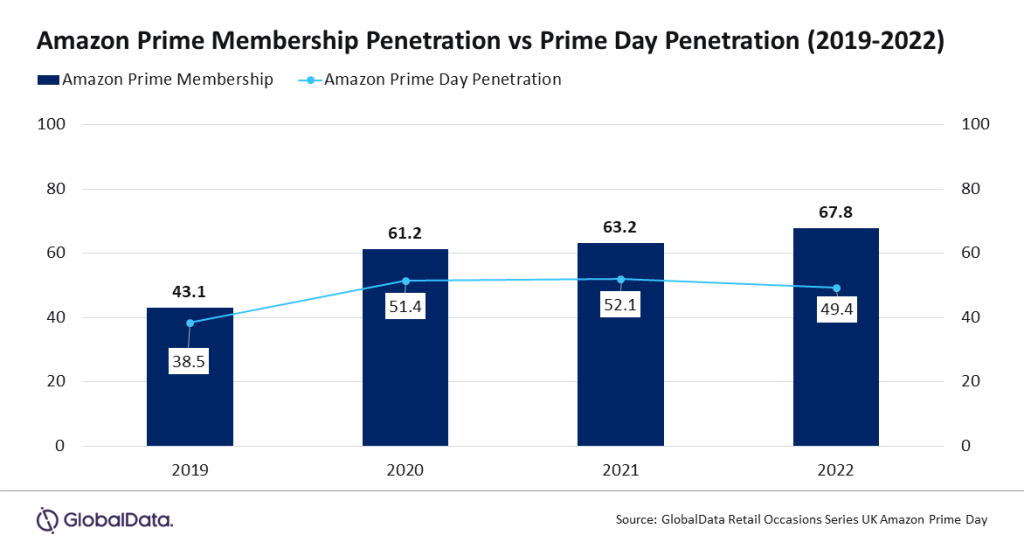

According to GlobalData’s Prime Day Surveys, the proportion of consumers with access to Prime membership has been accelerating since 2019, up 24.7ppts to reach 67.8% in 2022.

Yet, Simpson-Gould points out that “the proportion of consumers reporting that they bought something during Amazon Prime Day has not kept pace as Prime Day participation has only risen 13.6ppts over the same period.”

Consumer sentiment regarding retail spending has shown early signs of improvement, with GlobalData Retail’s retail spend index up 1.4 points to -61.1 in June 2023 compared to May 2023. This is calculated as respondents that expect to spend more minus the proportion of those that expect to spend less on retail over the next six months.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataYet, with the online non-food market forecast to experience a modest growth of 0.4% in 2023, GlobalData notes the online pureplay will have a challenging time encouraging shoppers to part with their cash.

Simpson-Gould concludes: “As the UK’s inflationary hangover will be slow to ease, Prime Day discounts will be scrutinised with a finer lens than ever before. Amazon’s purchasing power must come into play to secure deeper discounts than competitors.

“Homewares & furniture discounts should be a focus for Amazon due to the largest spend in these categories attributed to 35-44 year olds, who made up the largest age profile for UK Prime Day shoppers in 2022 at 26.8%. Coupled with the improving optimism regarding spending ability seen by this cohort in June, this group is a key target for promotions.”

GlobalData highlighted Amazon as a top 25 global retailer in 2022 due to its reported revenue growth of more than 5%.

GlobalData’s Amazon 2023 UK Prime Day Retail Occasions Series will be published in August 2023.